All Categories

Featured

Table of Contents

- – Generational Wealth With Infinite Banking

- – How secure is my money with Wealth Management ...

- – How do I leverage Privatized Banking System t...

- – What happens if I stop using Policy Loan Stra...

- – Who can help me set up Bank On Yourself?

- – Can I access my money easily with Life Insur...

- – What do I need to get started with Infinite ...

Term life is the best option to a short-lived demand for protecting against the loss of a breadwinner. There are far less factors for long-term life insurance policy. Key-man insurance coverage and as component of a buy-sell contract come to mind as a feasible great factor to buy an irreversible life insurance policy plan.

It is a fancy term created to offer high priced life insurance policy with adequate compensations to the representative and huge revenues to the insurer. Self-financing with life insurance. You can reach the very same end result as limitless financial with far better outcomes, more liquidity, no danger of a plan lapse triggering a huge tax problem and even more options if you use my options

Generational Wealth With Infinite Banking

My bias is great information so come back below and find out more short articles. Contrast that to the biases the promoters of infinity financial obtain. Right here is the video from the marketer made use of in this short article. 5 Mistakes Individuals Make With Infinite Financial.

As you approach your golden years, economic protection is a top concern. Amongst the several various economic strategies around, you might be listening to an increasing number of concerning infinite financial. Infinite wealth strategy. This concept makes it possible for almost any individual to become their very own bankers, offering some benefits and flexibility that could fit well right into your retired life plan

How secure is my money with Wealth Management With Infinite Banking?

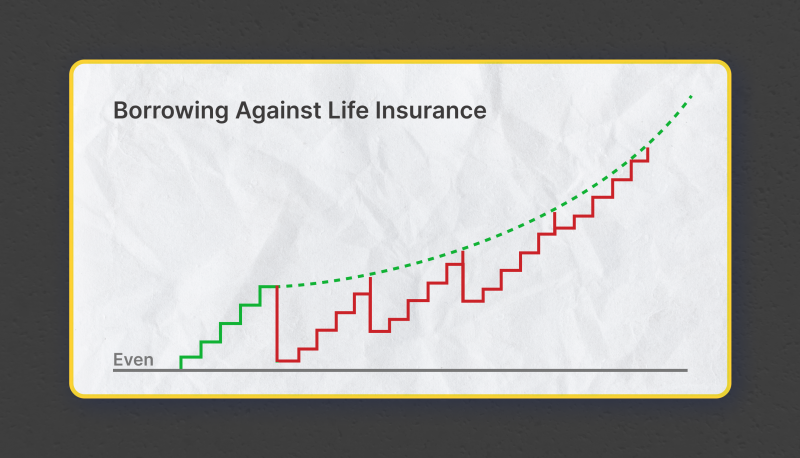

The car loan will build up basic rate of interest, however you maintain adaptability in establishing settlement terms. The rate of interest price is additionally generally less than what you 'd pay a traditional financial institution. This sort of withdrawal enables you to access a portion of your cash money worth (approximately the quantity you've paid in premiums) tax-free.

Several pre-retirees have problems about the safety and security of limitless banking, and for good factor. The returns on the money worth of the insurance plans may rise and fall depending on what the market is doing.

How do I leverage Privatized Banking System to grow my wealth?

Infinite Banking is a monetary technique that has actually acquired substantial attention over the past couple of years. It's a distinct strategy to managing personal finances, enabling individuals to take control of their money and develop a self-sustaining financial system - Cash flow banking. Infinite Financial, also recognized as the Infinite Banking Principle (IBC) or the Count on Yourself approach, is an economic strategy that entails utilizing dividend-paying entire life insurance plans to create an individual banking system

To recognize the Infinite Banking. Concept approach, it is consequently essential to provide an introduction on life insurance policy as it is an extremely misunderstood possession course. Life insurance policy is a crucial component of economic preparation that supplies numerous benefits. It is available in many shapes and dimensions, the most usual kinds being term life, entire life, and universal life insurance coverage.

What happens if I stop using Policy Loan Strategy?

Let's explore what each type is and exactly how they differ. Term life insurance coverage, as its name recommends, covers a specific duration or term, usually in between 10 to three decades. It is the most basic and typically the most inexpensive sort of life insurance coverage. If the insurance policy holder dies within the term, the insurer will certainly pay out the fatality benefit to the marked beneficiaries.

Some term life plans can be restored or exchanged an irreversible policy at the end of the term, however the costs typically enhance upon revival because of age. Whole life insurance is a sort of irreversible life insurance policy that offers coverage for the policyholder's entire life. Unlike term life insurance, it consists of a money worth part that expands with time on a tax-deferred basis.

It's crucial to bear in mind that any kind of outstanding finances taken against the plan will certainly lower the fatality advantage. Whole life insurance policy is normally much more pricey than term insurance due to the fact that it lasts a life time and develops cash worth. It additionally offers foreseeable premiums, implying the cost will certainly not raise with time, offering a degree of certainty for insurance policy holders.

Who can help me set up Bank On Yourself?

Some reasons for the misconceptions are: Intricacy: Whole life insurance policy policies have much more intricate functions compared to call life insurance policy, such as money worth buildup, dividends, and plan finances. These functions can be challenging to recognize for those without a history in insurance coverage or personal financing, causing confusion and misunderstandings.

Prejudice and misinformation: Some individuals may have had unfavorable experiences with entire life insurance coverage or listened to stories from others that have. These experiences and unscientific information can add to a prejudiced view of entire life insurance policy and bolster misunderstandings. The Infinite Financial Principle strategy can only be executed and implemented with a dividend-paying whole life insurance plan with a common insurer.

Whole life insurance policy is a sort of permanent life insurance policy that supplies insurance coverage for the insured's whole life as long as the premiums are paid. Entire life policies have 2 major parts: a survivor benefit and a cash value (Cash flow banking). The survivor benefit is the amount paid to recipients upon the insured's fatality, while the cash money value is a savings component that grows in time

Can I access my money easily with Life Insurance Loans?

Dividend payments: Common insurance coverage companies are had by their policyholders, and consequently, they may disperse earnings to insurance holders in the form of returns. While dividends are not ensured, they can assist boost the cash money worth development of your policy, raising the total return on your funding. Tax benefits: The cash worth growth within an entire life insurance policy policy is tax-deferred, suggesting you do not pay taxes on the development until you withdraw the funds.

Liquidity: The money worth of an entire life insurance coverage policy is extremely fluid, permitting you to access funds conveniently when needed. Possession protection: In several states, the money worth of a life insurance policy is shielded from creditors and lawsuits.

What do I need to get started with Infinite Banking Account Setup?

The policy will certainly have instant cash money worth that can be placed as security thirty day after moneying the life insurance plan for a revolving line of credit rating. You will certainly be able to gain access to with the revolving credit line up to 95% of the readily available cash money value and utilize the liquidity to fund a financial investment that offers income (cash circulation), tax benefits, the chance for appreciation and leverage of various other people's ability collections, abilities, networks, and funding.

Infinite Banking has ended up being extremely preferred in the insurance coverage world - also much more so over the last 5 years. R. Nelson Nash was the designer of Infinite Financial and the organization he founded, The Nelson Nash Institute, is the only organization that formally licenses insurance coverage agents as "," based on the adhering to requirements: They align with the NNI standards of expertise and ethics (Tax-free income with Infinite Banking).

They effectively complete an instruction with an elderly Accredited IBC Expert to guarantee their understanding and capacity to apply every one of the above. StackedLife is Authorized IBC in the San Francisco Bay Area and functions nation-wide, assisting clients understand and apply The IBC.

Table of Contents

- – Generational Wealth With Infinite Banking

- – How secure is my money with Wealth Management ...

- – How do I leverage Privatized Banking System t...

- – What happens if I stop using Policy Loan Stra...

- – Who can help me set up Bank On Yourself?

- – Can I access my money easily with Life Insur...

- – What do I need to get started with Infinite ...

Latest Posts

Bank On Whole Life

Infinite Banking Concept Pros And Cons

How To Become Your Own Bank And Build Wealth With ...

More

Latest Posts

Bank On Whole Life

Infinite Banking Concept Pros And Cons

How To Become Your Own Bank And Build Wealth With ...